We keep it simple

When you can choose a payment option that suits your budget, it’s easy to get that interview outfit or go on your dream vacation.

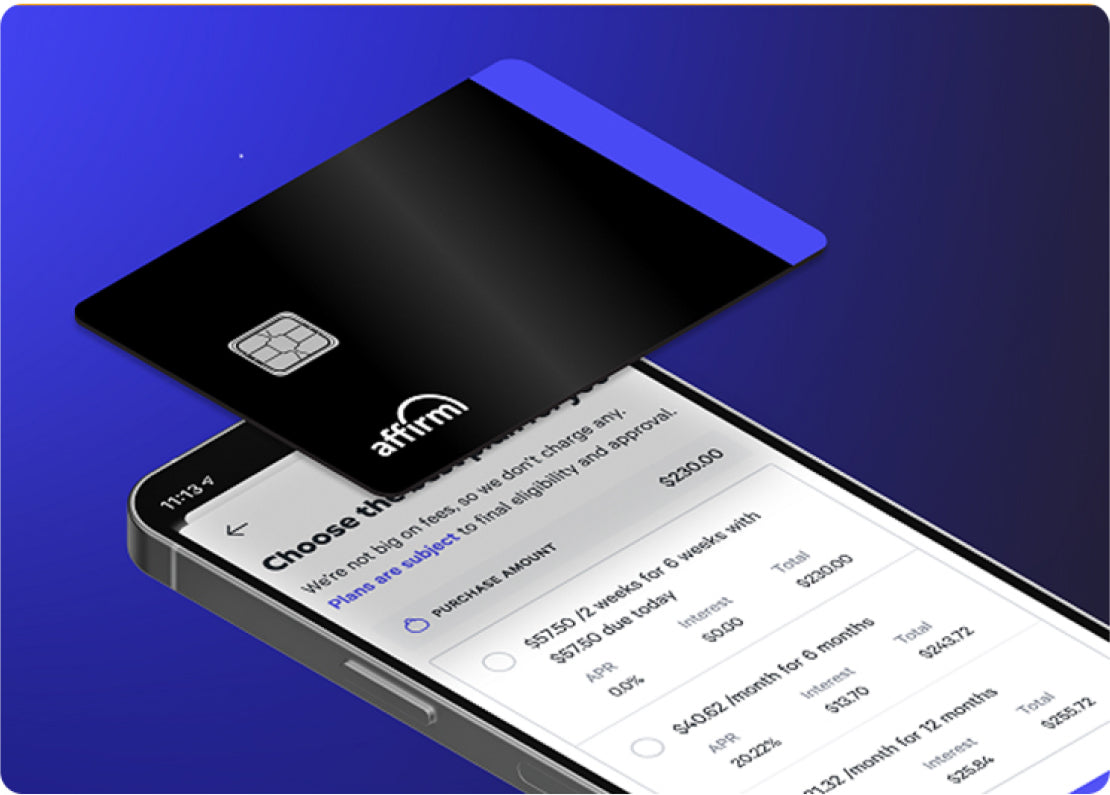

We never charge fees

You'll never pay late fees. Or annual fees. Or hey-it's-a-random-day-in-April fees.

We tell it like it is

With credit cards, the longer you take to pay off your balance, the more expensive your purchase becomes. With Affirm, you always know exactly what you'll owe and when you'll be done paying off your purchase.

It’s all about you

From shopping for the latest kicks to booking your dream vacation, whatever you’ve got going on—we’re here to help.

Transparent

We tell you up front the total amount you’ll pay. That number will never go up.

Flexible

You choose the payment schedule that works for you.

Fair

You’ll never pay late fees, penalties, or hidden interest, ever.